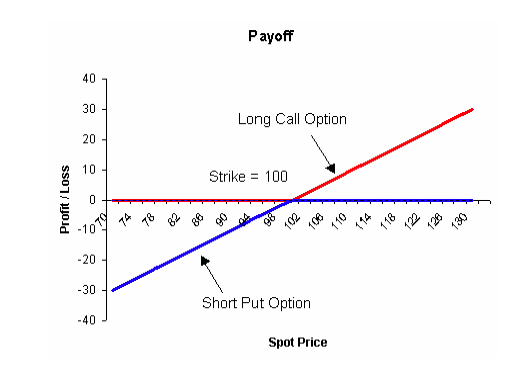

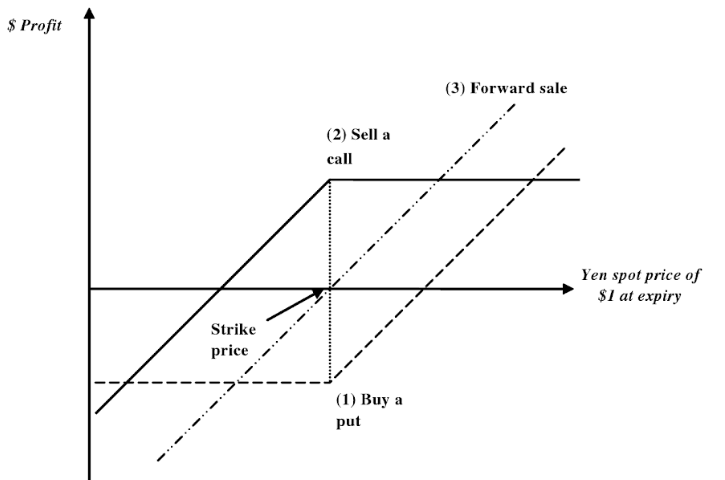

Derivatives Crash Course for Dummies: What is wrong with the payoff profile of the synthetic forward? - FinanceTrainingCourse.com

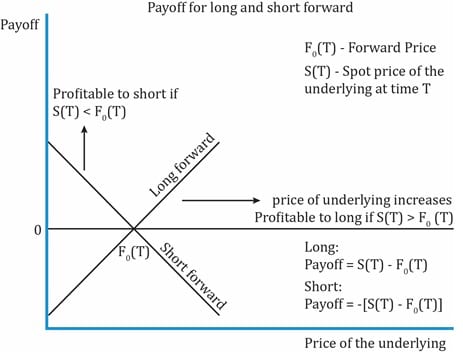

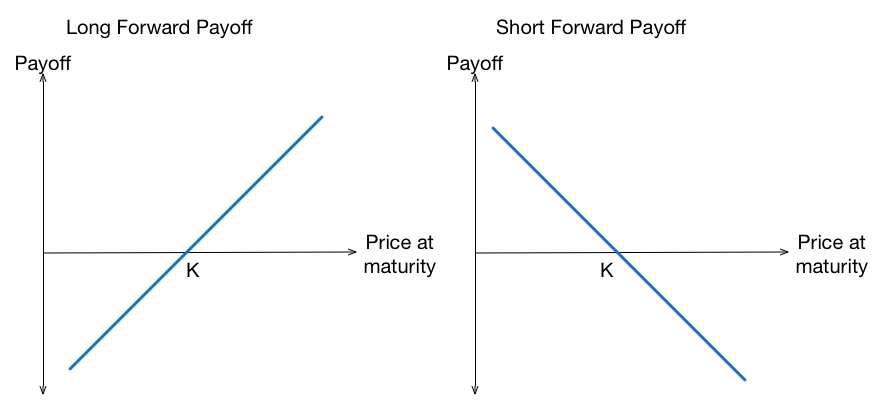

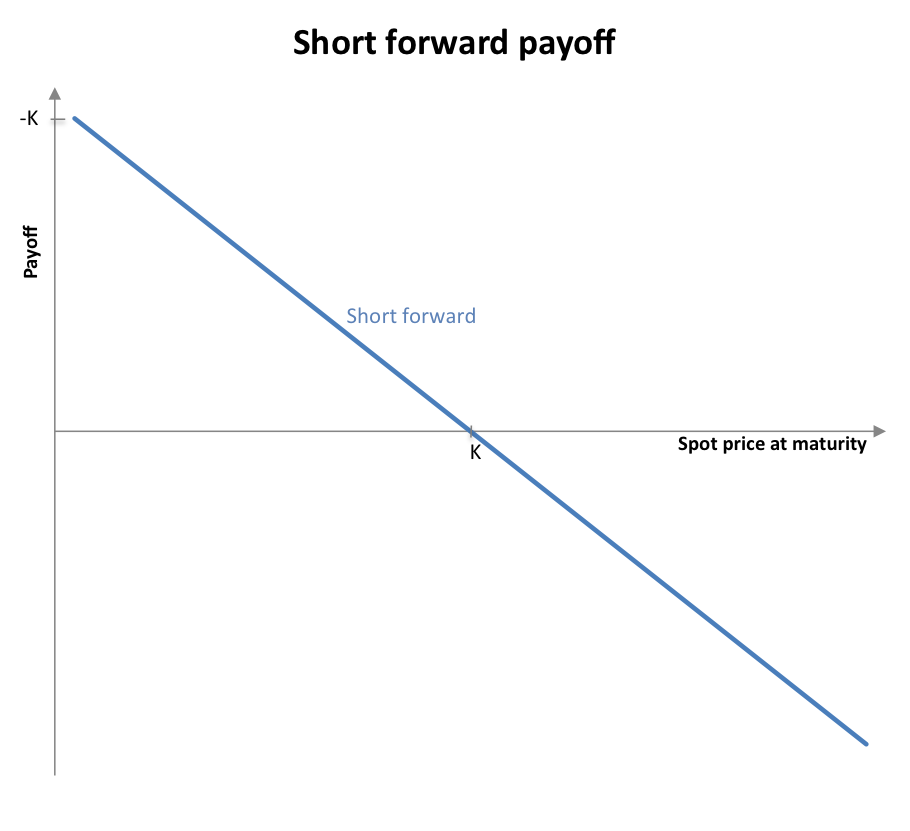

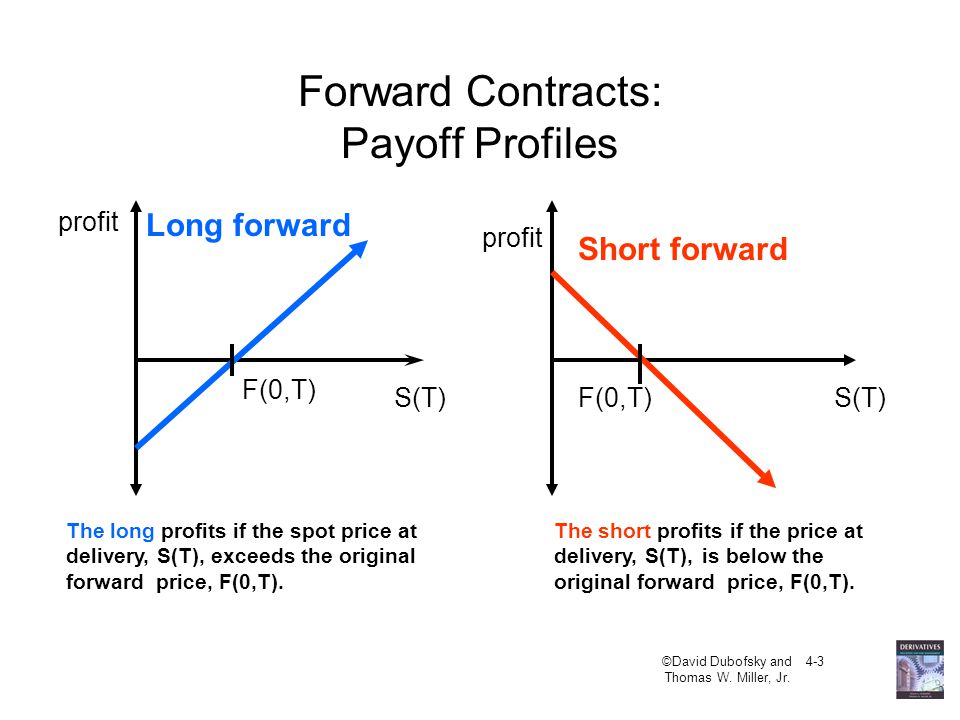

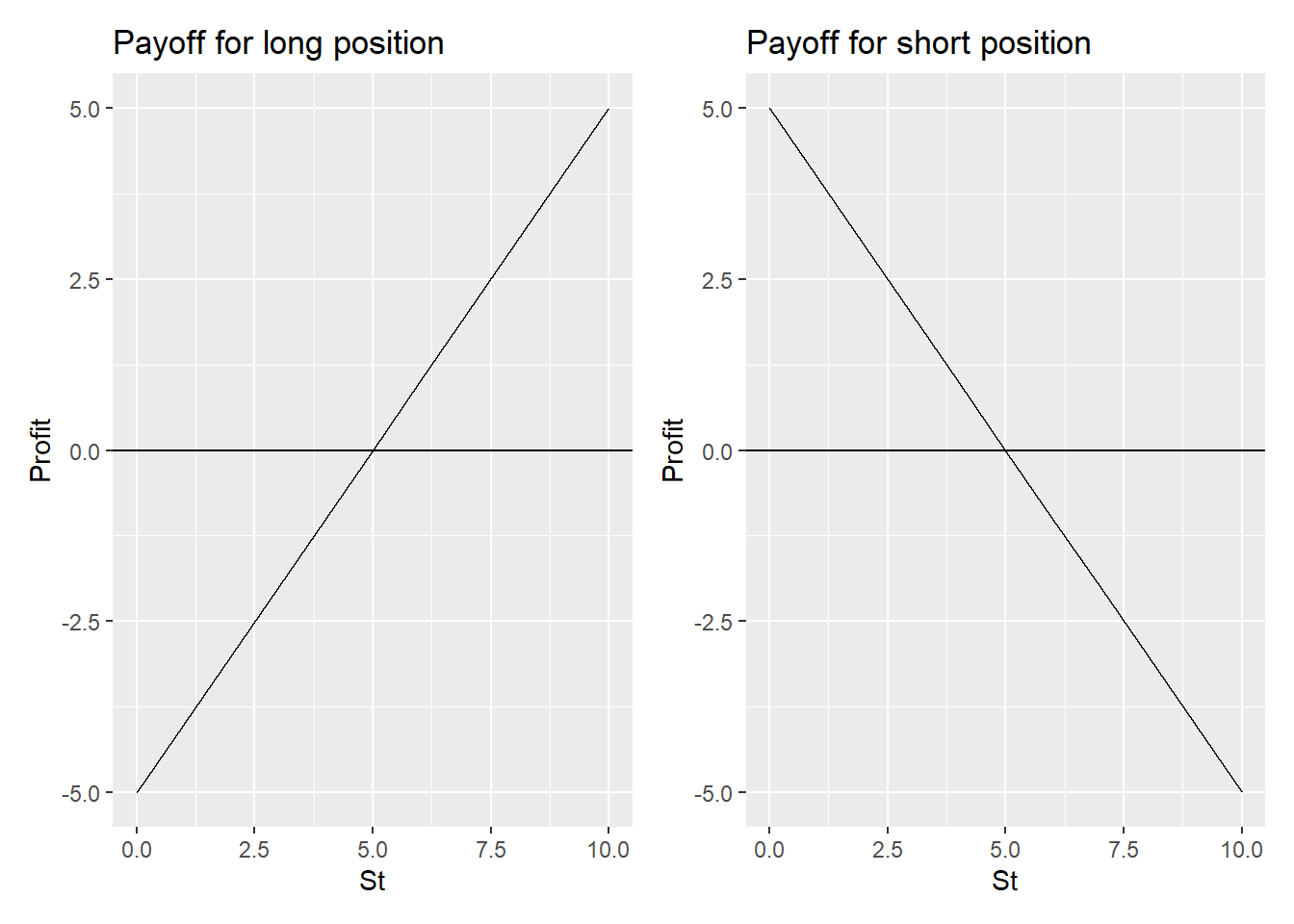

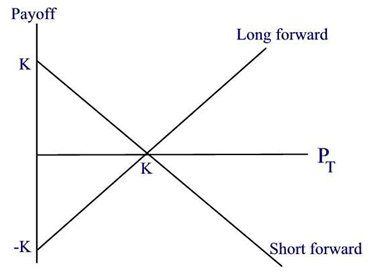

Payoff diagram of long forward and short forward Where S T is the spot... | Download Scientific Diagram

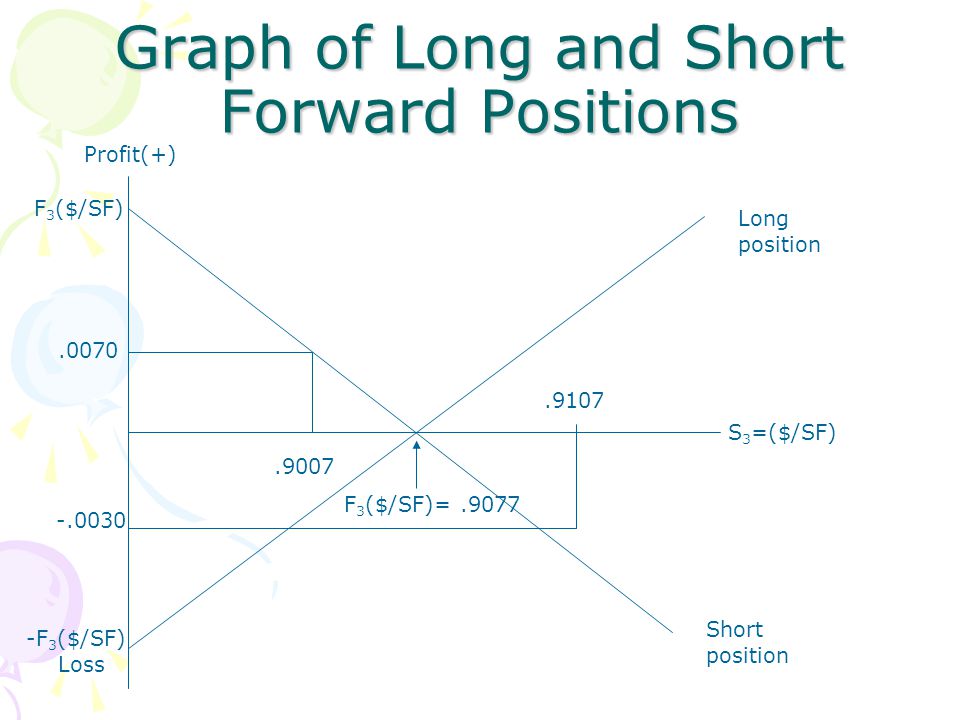

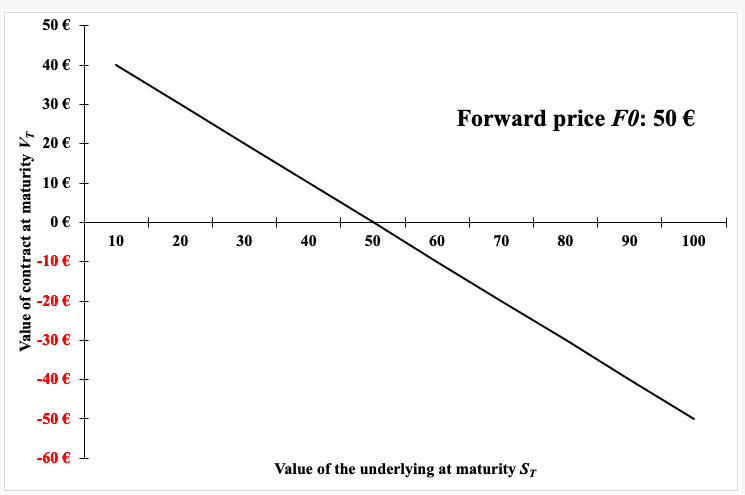

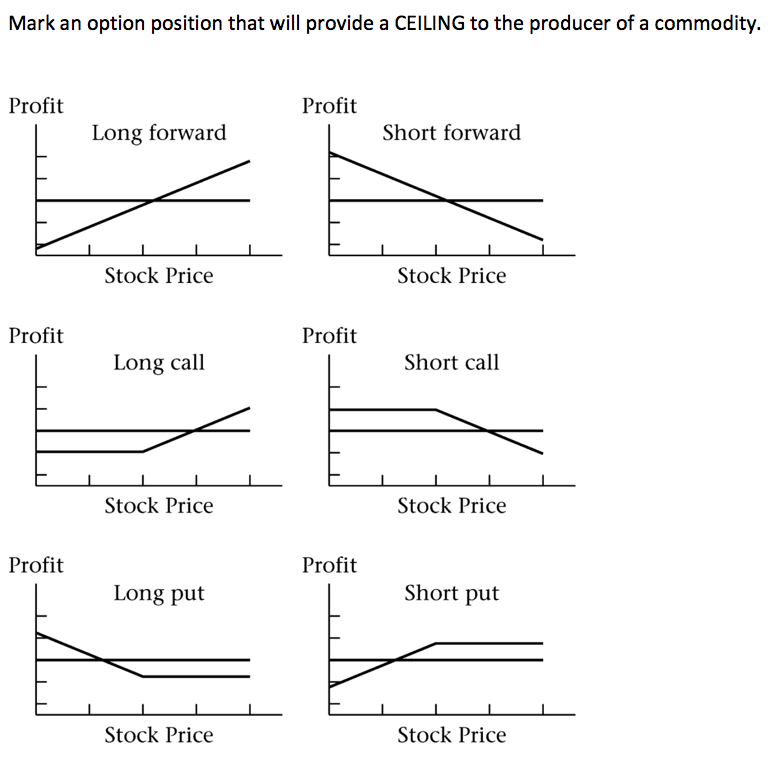

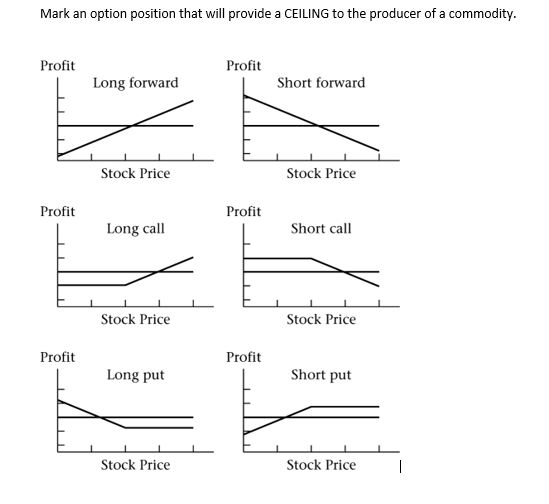

An off-market forward contract is a forward where either you have to pay a premium or you receive a premium for entering into the contract. (With a standard forward contract, the premium